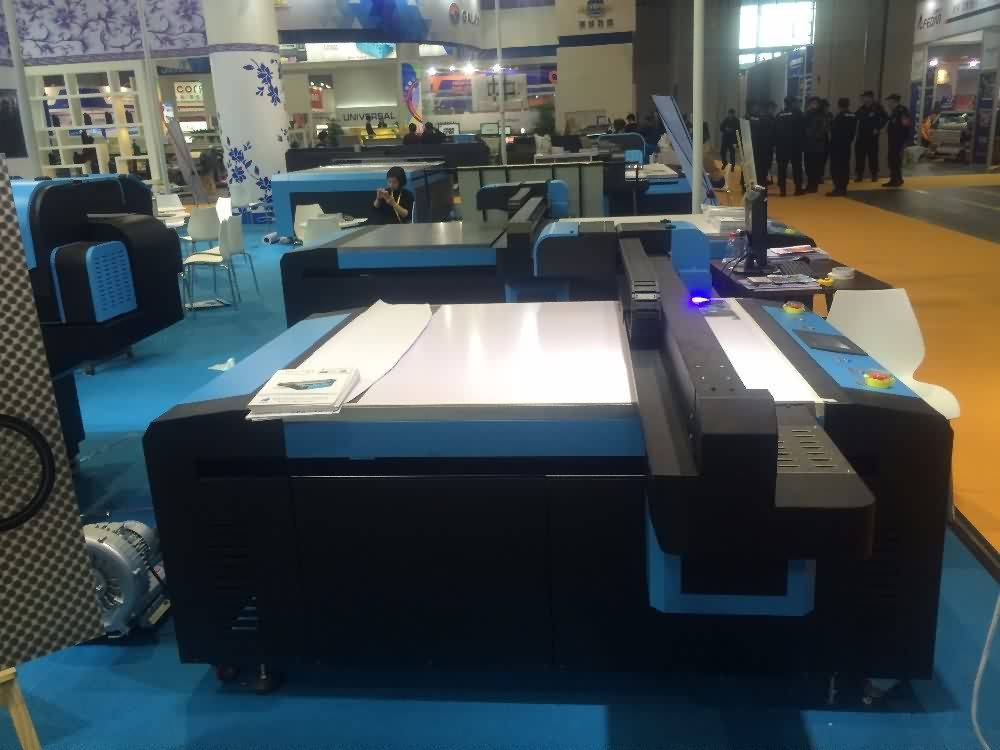

11 Years Factory Flat panel printing machine, UV Flatbed Printer UV2513 for Atlanta Manufacturers

Out of Stock

11 Years Factory Flat panel printing machine, UV Flatbed Printer UV2513 for Atlanta Manufacturers Detail:

Quick Details

- Type: Digital Printer

- Condition: New

- Plate Type: Flatbed Printer

- Place of Origin: Anhui, China (Mainland)

- Brand Name: COLORIDO-Flat panel printing machine, UV Flatbed Printer UV2513

- Model Number: CO-UV2513

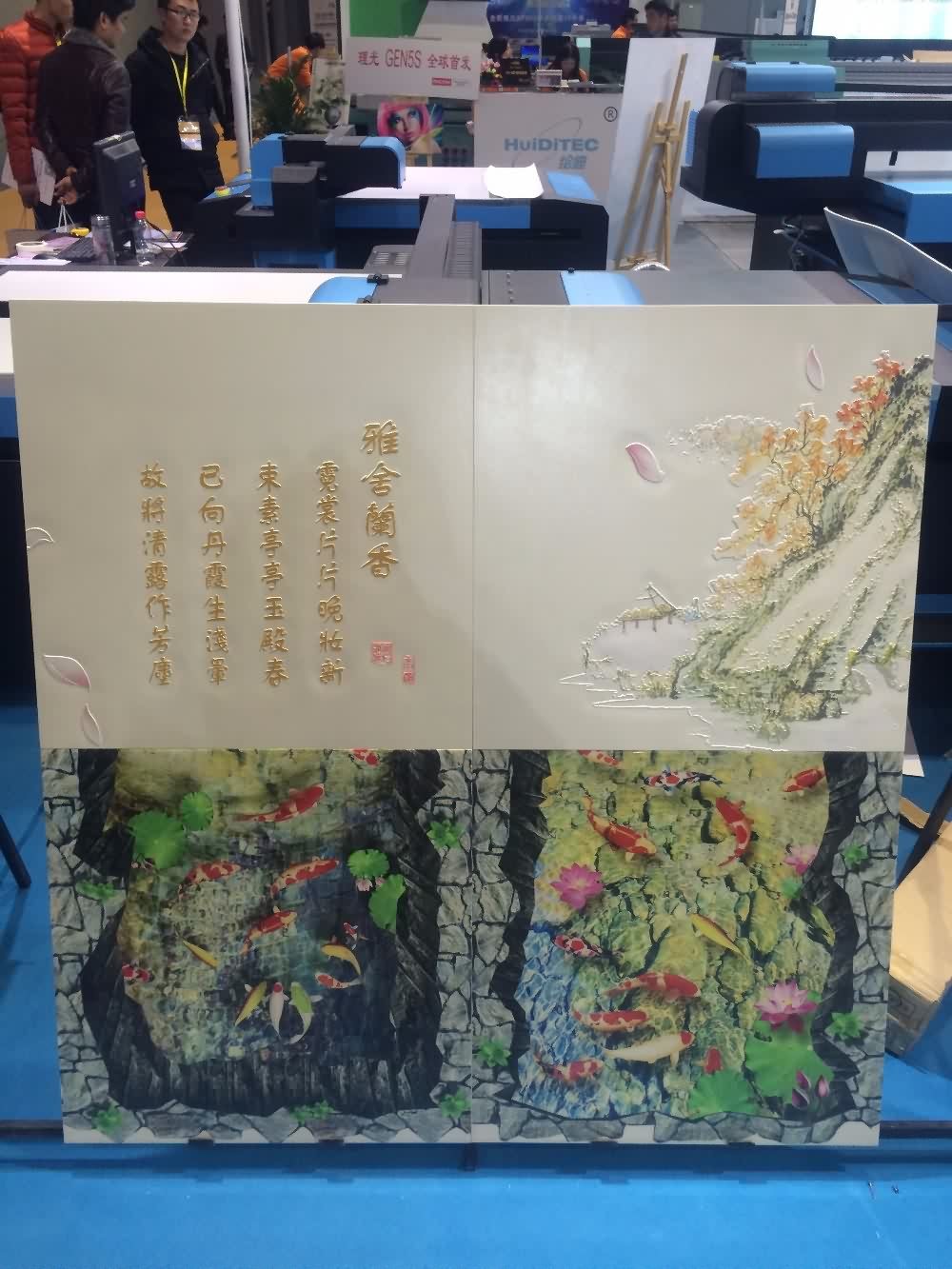

- Usage: Bill Printer, Card Printer, Label Printer, ACRYLIC,ALUMINUM,WOOD,CERAMIC, METAL,GLASS,CARD BOARD ETC

- Automatic Grade: Automatic

- Color & Page: Multicolor

- Voltage: 110~220v 50~60hz

- Gross Power: 1350w

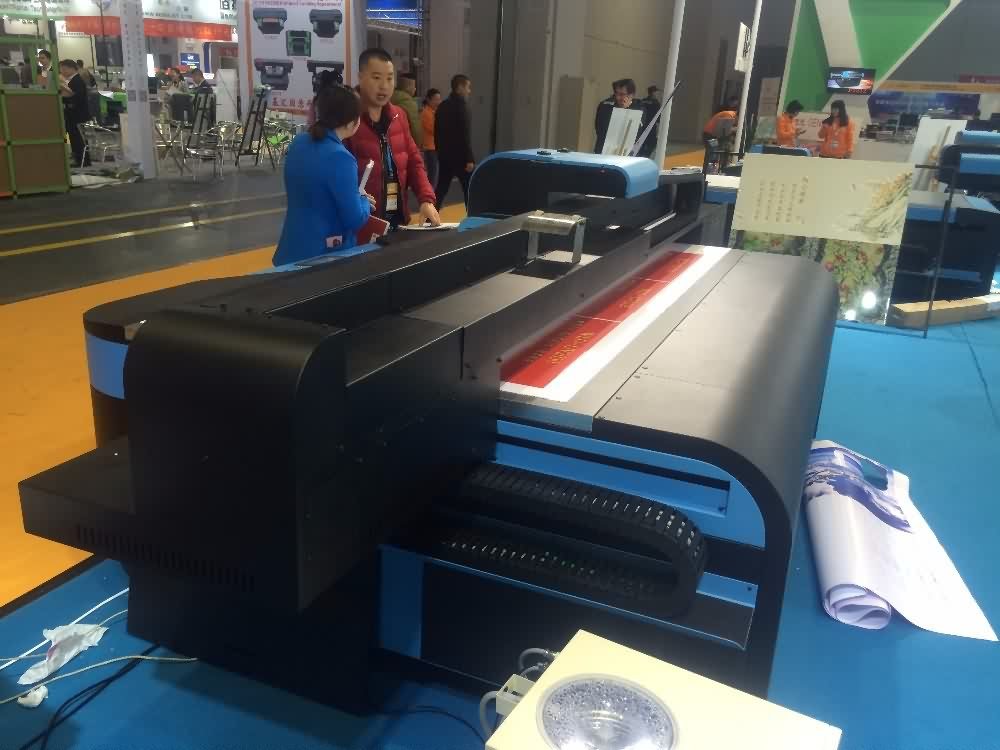

- Dimensions(L*W*H): 4050*2100*1260mm

- Weight: 1000KG

- Certification: CE Certification

- After-sales Service Provided: Engineers available to service machinery overseas

- Name: Flat panel printing machine, UV Flatbed Printer UV2513

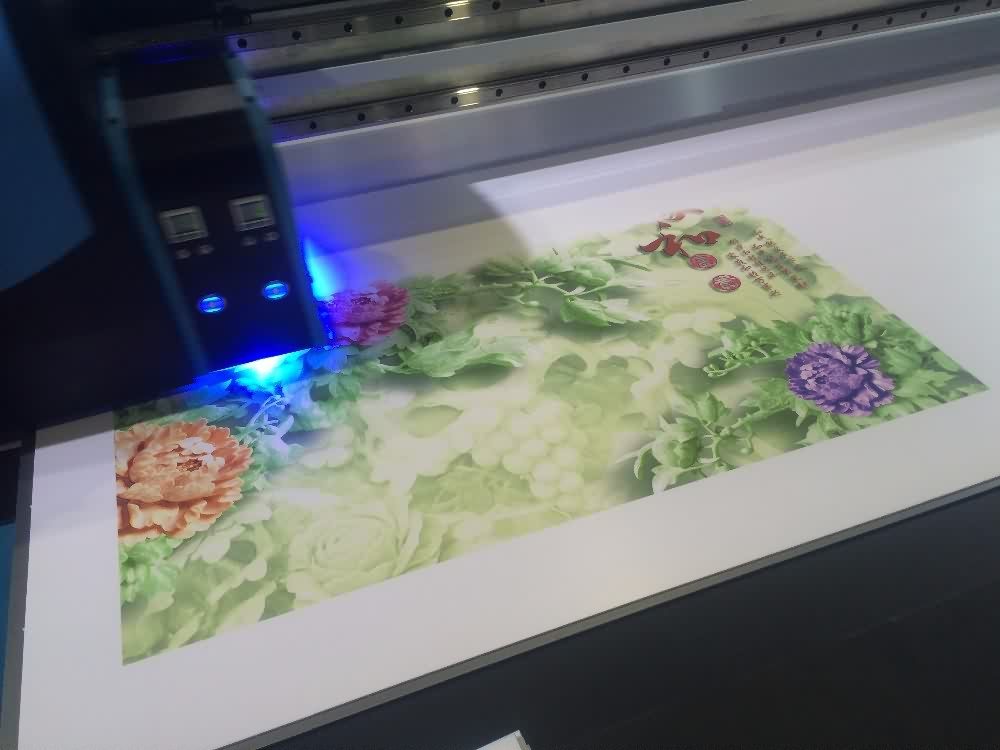

- Ink: LED UV INK,ECO-SOLVENT INK,TEXTILE INK

- Ink system: CMYK, CMYKW

- Print speed: Max 16.5m2/hr

- Print head: EPSON DX5,DX7, Ricoh G5

- Printing Material: ACRYLIC,ALUMINUM,WOOD,CERAMIC, METAL,GLASS,CARD BOARD ETC

- Printing size: 2500*1300mm

- Printing thickness: 120mm( or customize thickness)

- Printing resolution: 1440*1440dpi

- Warranty: 12 Months

Packaging & Delivery

| Packaging Details: | INDIVIDUAL WOODEN BOX PACKAGE(EXPORT STANDARD) L 1200 *W 1230* H 870 MM 350KG |

|---|---|

| Delivery Detail: | Shipped in 15 days after payment |

Product detail pictures:

Related Product Guide:

What Is UV Flat-Panel Printer?

Understanding the Basics of Digital Textile Printers

We insist on the principle of development of 'High quality, Efficiency, Sincerity and Down-to-earth working approach' to deliver you with great provider of processing for 11 Years Factory Flat panel printing machine, UV Flatbed Printer UV2513 for Atlanta Manufacturers , The product will supply to all over the world, such as: Malta, Montpellier, Birmingham, Now, with the development of internet, and the trend of internationalization, we have decided to extend business to overseas market. With the propose of bringing more profits to oversea customers by providing directly abroad. So we have changed our mind, from home to abroad, hope to give our customers more profit, and looking forward to more chance to make business.

This company has the idea of "better quality, lower processing costs, prices are more reasonable", so they have competitive product quality and price, that's the main reason we chose to cooperate.